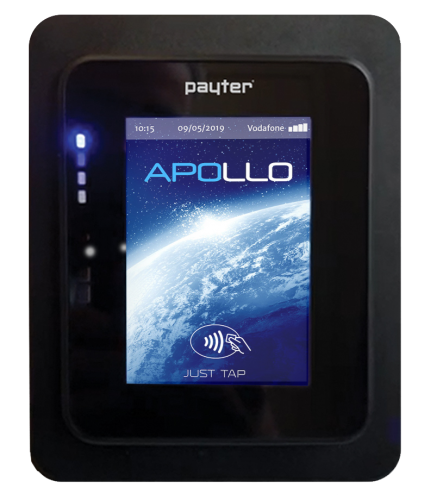

Introducing ApolloOne Giant Leap for Cashless Technology

Fully EMV Certified with Integrated Contact and Contactless Payments

Fully EMV Certified with Integrated Contact and Contactless Payments

Supports Closed Loop Systems Including Campus Cards and Loyalty Programs

Supports Closed Loop Systems Including Campus Cards and Loyalty Programs

3.5" High-Resolution Touchscreen Display with PIN-on-Glass

3.5" High-Resolution Touchscreen Display with PIN-on-Glass

Designed for All Unattended Markets: Kiosks, Vending, Mass Transit, Parking, and More

Designed for All Unattended Markets: Kiosks, Vending, Mass Transit, Parking, and More

PayZang is a leading provider of payment technology, processing, and services.

We provide hardware, merchant accounts, and gateways to optimize financial goals and customer engagement all on one user-friendly platform. Our comprehensive resources allow businesses around the world to conduct commerce with streamlined data management and ultramodern payment devices—in unattended and attended environments, online and in-person. All products are compliant with international security standards and feature genius technology and design.

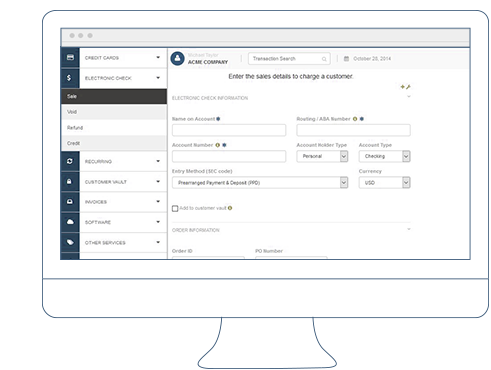

Credit Card and ACH Processing

Drive your payment solutions into the digital fast lane with PayZang’s all-inclusive merchant services.

- Contactless Transactions

- Mobile Processing

- Online Payments

- Recurring Transactions

- Electronic Invoicing

Cashless and Contactless Technology

Give customers the flexibility to make safe and speedy purchases. Our cashless devices accept mobile pay and all major cards via swipe, tap, or dip; they operate autonomously and can be logo branded. Transactions are fully secure with PCI SSC P2PE, certified by Mastercard, Visa, American Express, and Discover.

Modernize vending machines. Expedite long lines. Seamlessly manage all processes on one platform. Our leading-edge technology offers easy plug and play to bolster business in every industry.

Cashless payment terminals are weatherproof, small enough to be handheld, and savvy enough to be integrated with a video exhibit. Hardware is manufactured in-house, with faster time to market and lower prices than competitors.Activation is quick and comprehensive. We streamline the system (merchant IDs are ready in minutes!) and eliminate the need for third parties.

Why is PayZang right for you?

Low-Cost Processing Fees

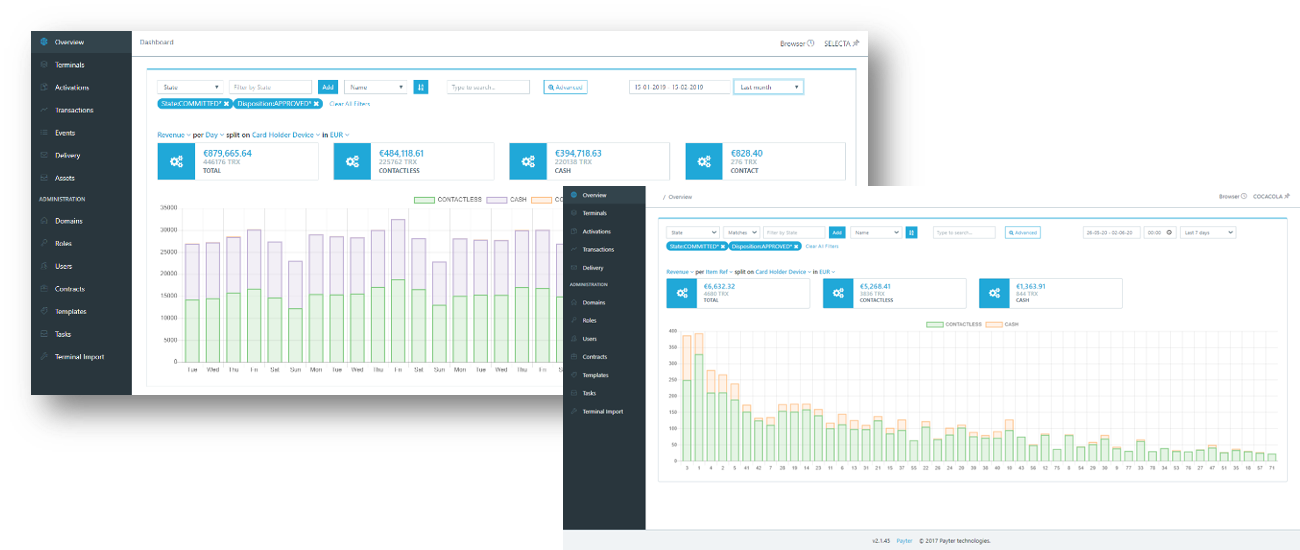

Complete Management System

Secure and Swift Payments

Proficient Customer Service

End-to-End Payment Management

Enjoy a complete toolkit for managing payments. PayZang provides custom online pages, multiple payment channels, and options for one-time or recurring transactions. We intelligently align our products with your existing operations.

Employ hand held or stationary devices, mobile apps, and virtual deposits. Kiosks can be customized with an interactive display designed by our savvy team. Intuitive, time-saving software tracks your consumers’ data, amount totals, payment cycles, and most profitable locations (lobby, city plaza, market, festival, online). Benefit from comprehensive reporting and forecasting tools. The Account Updater feature obtains and maintains up-to-date credit and debit card information. No need to worry about lost account numbers due to expiration, theft, or change of address. And much more...

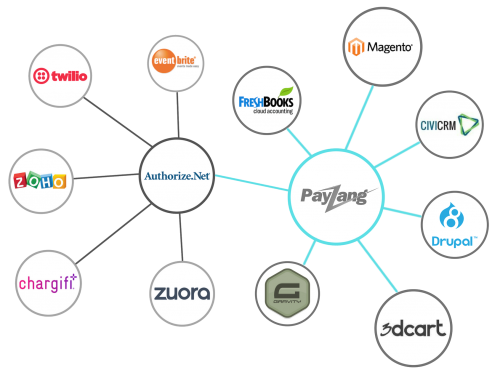

The Most Comprehensive Plugin Ecosystem

PayZang easily integrates with Authorize.net—the most widely used online payment processing and management support. Maintain your current service or migrate to our portal that provides more than 175 software and service features in a variety of categories.

Integration

PayZang's solutions are incorporated multiple ways within a website or mobile platform. Options vary based on ease of integration, required resources, features, and additional security. We partner with Trustwave to provide free PCI vulnerability scan for our partners. We also offer EMV Chip Card SDK for organizations that interface directly with EMV devices.

Discover the details >>